Try our learning program for free!

STEMVentor LMSDigital Payments Part 1

Vikas Mujumdar, April 1, 2020

I am going to start with quick definitions of and the difference between the terms money and currency. Readers with knowledge of finance will find this trivial and simplistic. But others, who understand colloquial definitions and use these terms interchangeably may find it interesting.

Money and Currency

Money is an economic unit that is generally accepted as a measure for payment for goods and services and repayment of debts or taxes. There are broadly two kinds of money: Fiat Money and Commodity Money.

Fiat money has no intrinsic value, rather it has value only because a government maintains its value, or because parties engaging in an exchange agree on its value. In contrast, commodity money is backed by some commodity, generally of high intrinsic value (in today's world, largely gold).

The value of precious metals like gold, is inherent in their scarcity. Precious metals exist in a finite amount and historically and thus far, there has only been so much gold that can be mined. Because of this, while the quantum of fiat money can be increased at a government’s whim, commodity money cannot be increased at will without first acquiring more of the commodity itself.

Currency is a physical representation of money, in the form of paper or coins, usually issued by a government and generally accepted at its face value and physically exchanged as a method of payment. Currency is the rupees, dollars, euros, pounds that you keep in your purse or wallet (or money clip).

Having a currency backed by an actual precious metal helps lend credibility to the governments that issue it. It facilitates the trust these institutions needed to make their currency system work. People accepted currencies because they knew their wealth was secured in (i.e. backed by) a precious metal. Yet, most modern paper currencies are fiat currencies, including the U.S. dollar, the euro and other major global currencies. This is primarily because a fiat currency gives governments' central banks greater control over the economy because they control how much currency is printed.

Since the start of trade, goods and services were paid for in some currency – directly precious metal coins or currency coins or paper. As the value and quantum of currency exchange for trade increased, it became safer and more convenient for traders (or businesses) and even individuals to keep money in a trusted and regulated entity. This led to the emergence of the banking ecosystem, with banks acting as the "safe keepers" of money, with a dedicated "account" for each business or individual that tracked the amount of money deposited for safe-keeping.

With money now kept in bank accounts, traders, businesses and individuals would need a way to exchange money for the trades they did. One way of course was for the buyer to withdraw from their bank an amount of currency required for the trade and hand over the currency to the receiver who could then deposit it into their own bank account. But if the value of the trade was high, withdrawing, exchanging and depositing currency would become a challenging task. To solve this problem, payment instruments and more broadly, payments systems were introduced.

Payment systems have evolved tremendously over the last many years and today there are a multitude of options, both physical and digital, each one offering some benefit and convenience to the customer. Several entities were introduced with each new system but one thing that you will see remains common across all these options, is the existence of an underlying bank and a bank account.

In this two-part article we will explore the journey of payments systems from the earliest cheque clearing to the latest Unified Payments Interface (UPI).

Cheques

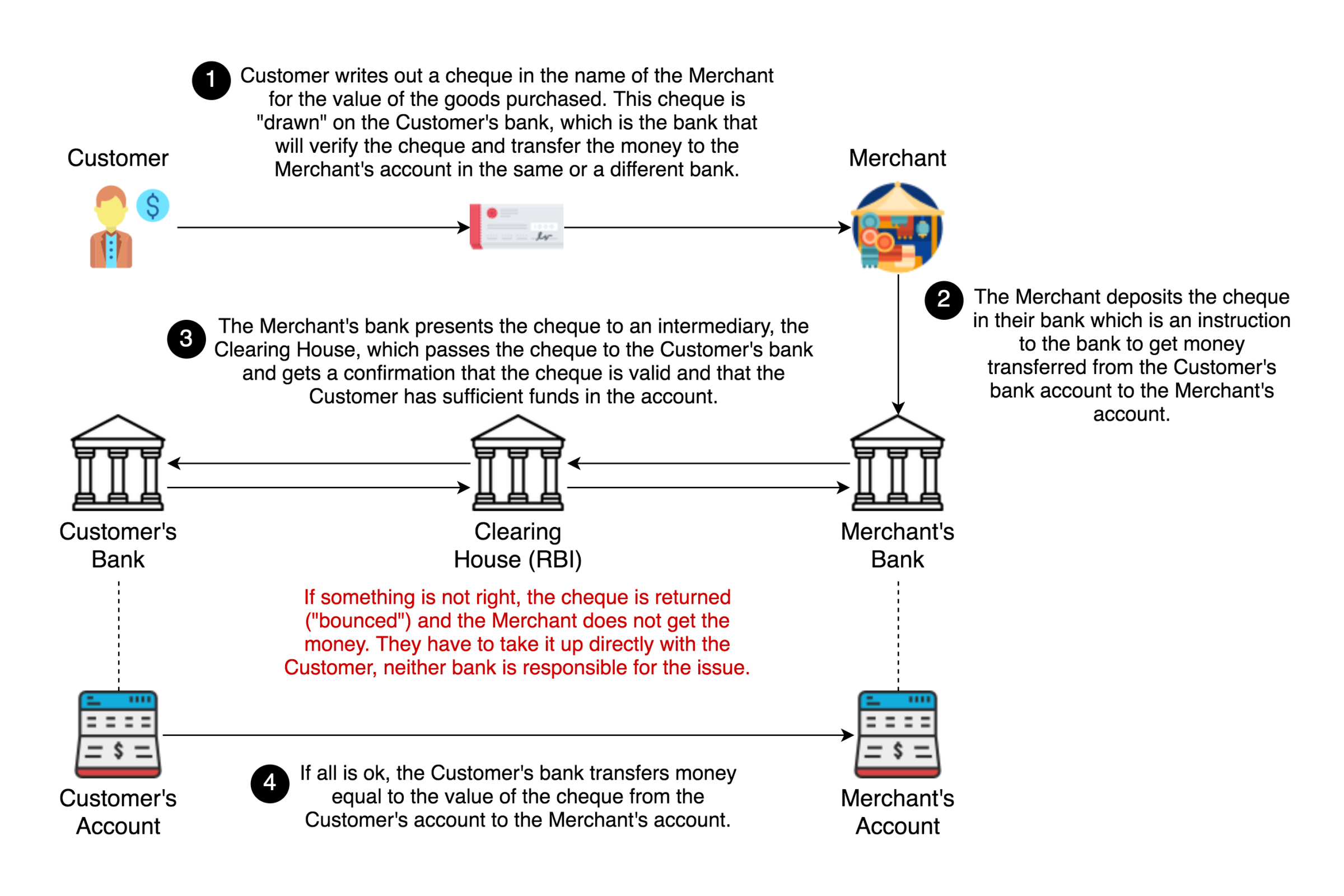

For effecting transfer of money from one bank account to another, a payment instrument was needed to instruct the bank to initiate the transfer. This instrument was what we know as the cheque. The ecosystem to manage money transfer now comprised of the payer's bank, the beneficiary's bank and a cheque clearing house (that facilitated the processing of cheques between banks), together forming a payment system.

The process for a cheque-based payments system is illustrated below:

While cheques were a convenient instrument, the cheque clearing process was very cumbersome and would take days. A common term in those days was "delivery of goods is subject to realisation of the cheque" as the seller could not be sure the cheque would be "cleared" which was only confirmed after the clearing house verified that the cheque was valid and authorised by the account holder and the payer's bank account had sufficient money. Over time the clearing process was made significantly more efficient with the use of modern technology but it still had a delay of a few hours, and sometime days.

For payments of a recurring nature, from one entity to multiple beneficiaries, such as salary or dividend payments, or from multiple entities to one entity, such as utility bill payments, a solution known as Electronic Clearing Service(ECS) was introduced which automated inter-bank, inter-account transfers without the need for a cheque.

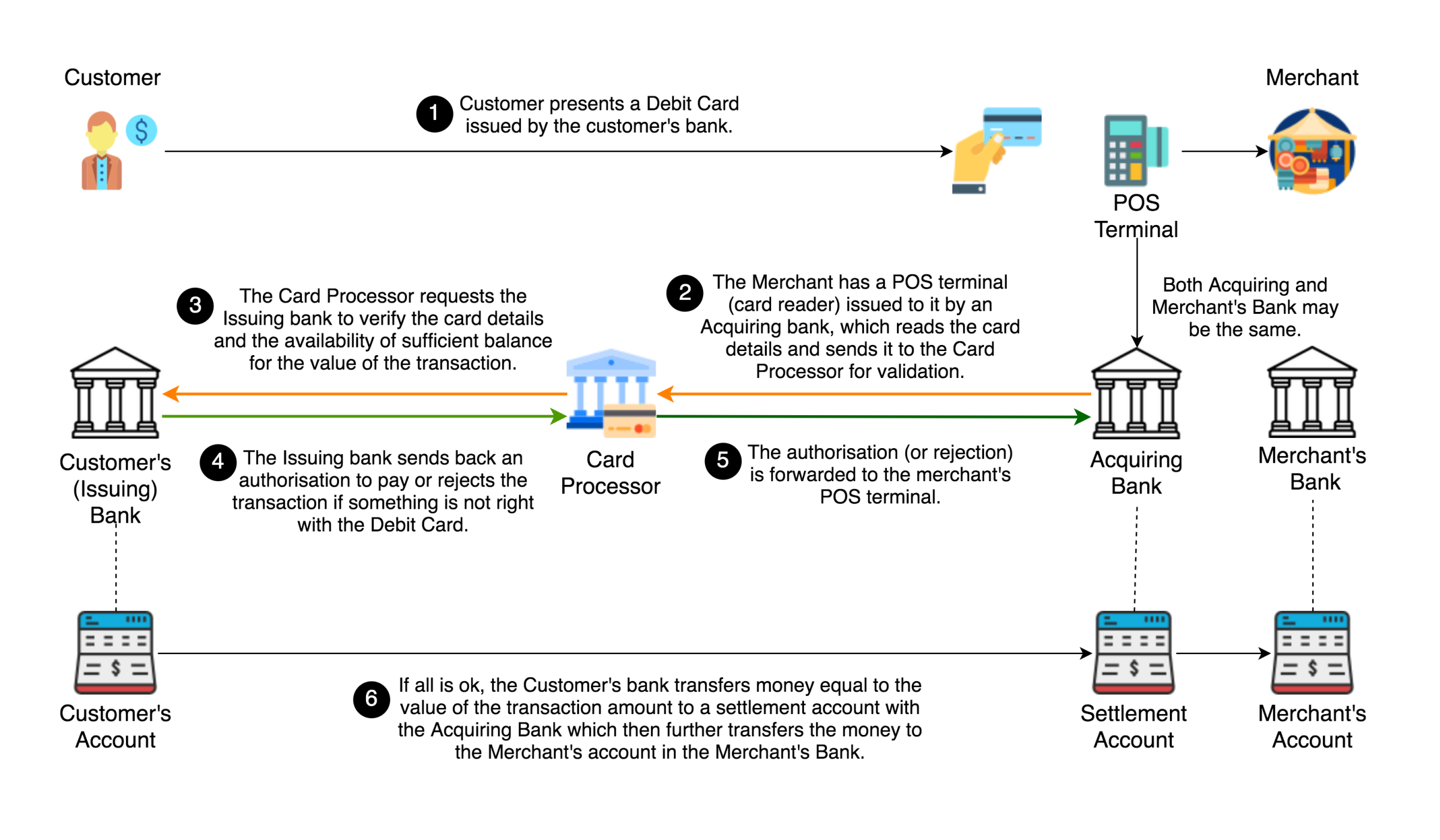

Debit Cards

Banks introduced another innovative payment instrument, the debit card. The debit card now replaced cheques, especially at retail outlets (or merchants). Using a point-of-sale (card reader) device and a card processing network, the merchant sends a request to the bank that has issued the debit card to verify if the customer has sufficient funds for the amount of the transaction. Within a few seconds, the bank will respond with an approval or a rejection of the transaction depending on whether or not the card is valid and there are sufficient funds in the customer's account. If approved, the bank will immediately debit the customer's account by the amount of the transaction. The total amount due to the merchant for all transactions using the bank's debit card are settled (transferred from the bank's settlement account to the merchant's account, in the same bank or any other bank) at the end of the day or the next working day.

While quite a convenience for the customer, this is not totally digital yet as the customer must possess a physical card, the merchant must possess a point-of-sale device and finally, the merchant gets the money due only after a certain time lag. This still held a huge advantage for the merchant over a cheque since the real-time approval from the bank meant the payment was assured, unlike with a cheque which may bounce (have insufficient funds in the account) after the merchant had already sold the goods or services to the customer.

The process for a debit card payments system is illustrated below:

Credit cards are a very close cousin of debit cards and the process flow is quite similar. However, credit cards follow a different business paradigm in that payments are authorised and made from a line of credit given to the customer, not from the customer's actual money in the bank account. A credit card is really useful when the customer does not have sufficient money in the bank account to pay for a transaction, or if the customer wants to hold on to the money in the bank account and pay later.

For the convenience to the merchant of online validation, therefore reducing risk, and a faster settlement of money to the merchant, the entities in the process chain charge a fee, which is recovered from the merchant.

Digital Payments – The Beginning

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single bank or across multiple banks, via computer-based systems, initiated by the account holder, without requiring intervention of bank staff.

While the payment systems mentioned so far were common across the world with minor variations, EFT protocols were defined by country or region and evolved at their own speed, depending on the demands of their users. From this point on, all discussions will be on the payment protocols and systems in India.

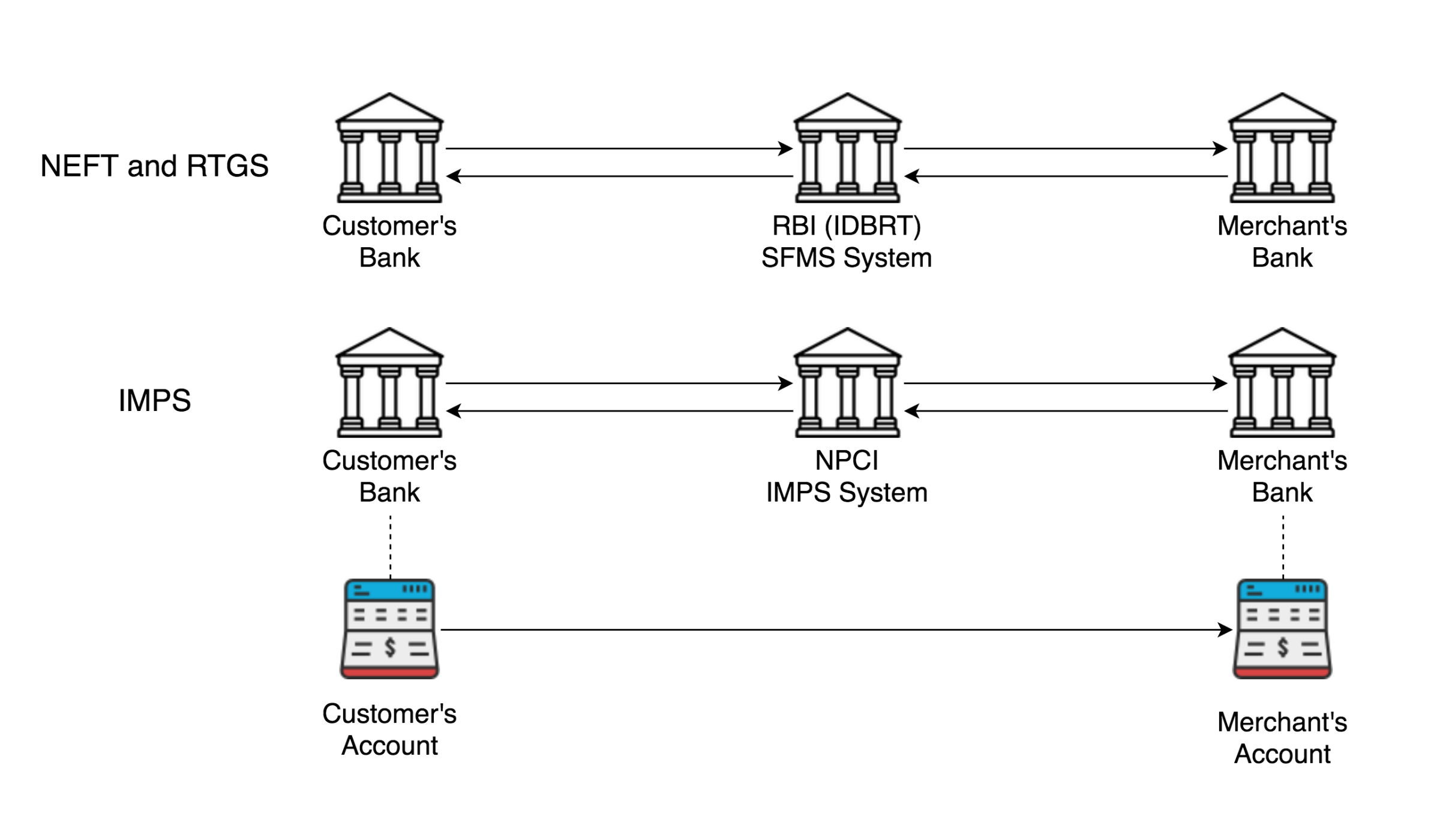

As banking systems evolved and transaction volumes grew and the need for speed increased, multiple funds transfer protocols were introduced. In order, in India, we have NEFT (National Electronic Funds Transfer), RTGS (Real-time Gross Settlement) and IMPS (Immediate Payment Service).

The difference between the three protocols is in the speed of transfer. NEFT and RTGS run in batches and are operational only during bank working hours, resulting in a delay (ranging from a few minutes to possibly a few days) between the time a transfer request is initiated and the transfer actually happens. IMPS transfers in contrast happen immediately, and the process runs 24x7x365. Although, at the time of this writing, NEFT has also been made operational 24x7x365 but it is still processed in half-hourly batches.

Why would you not always choose IMPS? Since real time processing requires a higher investment in infrastructure by the banks and regulators, they will seek to recover their costs by charging customers a higher transaction fee for IMPS as compared to NEFT or RTGS. However, as technology evolves and costs go down, it is conceivable that all transactions happen using IMPS and the other protocols are no longer needed.

There is one other major difference with IMPS – it is a service offered by a relatively new entity in the Indian payments ecosystem, the National Payments Corporation of India (NPCI), while the other two are offered by the Reserve Bank of India (RBI), the country's central bank and regulator.

These protocols, especially IMPS, are the foundation of online payments using what is known as Internet or Mobile Banking. Customers can now log in to a bank's website or mobile app and instruct the bank to transfer money to another account. The system will use one of the three EFT protocols to effect the transfer, the choice depending on the nature of the transaction. While a delayed confirmation is an acceptable online shopping experience for some goods, say for example physical goods such as books, electronics, apparel, grocery and so on, it is not acceptable when making an airline or any other travel reservation where the confirmation for each payment request needs to be immediate so that the seat is blocked. Delayed confirmation is also not acceptable in an online food or cab ordering service, where the food or cab must be confirmed immediately and delivered within a very short time frame (not long enough to wait for the next EFT cycle even if in a few hours).

This development marks the start of the digital payments era. Technology, systems and protocols evolved further to make payments not only real time but seamlessly integrated with online e-commerce systems where customers could order goods and services and pay for them immediately and digitally requiring no currency or cheques or even any direct interaction with a physical bank.

In Part 2, we will read about how digital payments systems have evolved and how each one works and the entities involved, which have grown to quite a few more than just the banks and a clearing house.